Jeff Madrick is an Economics columnist and author of Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present (2011). In The Washington Post, he argues that, while the USA cannot live without Wall Street, the latter has moved away from its primary function—to support small businesses and engender economic growth. For too long, it has served the personal interests of an elite few.

Madrick argues that American society needs to shift its thinking about Wall Street – to start thinking of it as “expendable.”

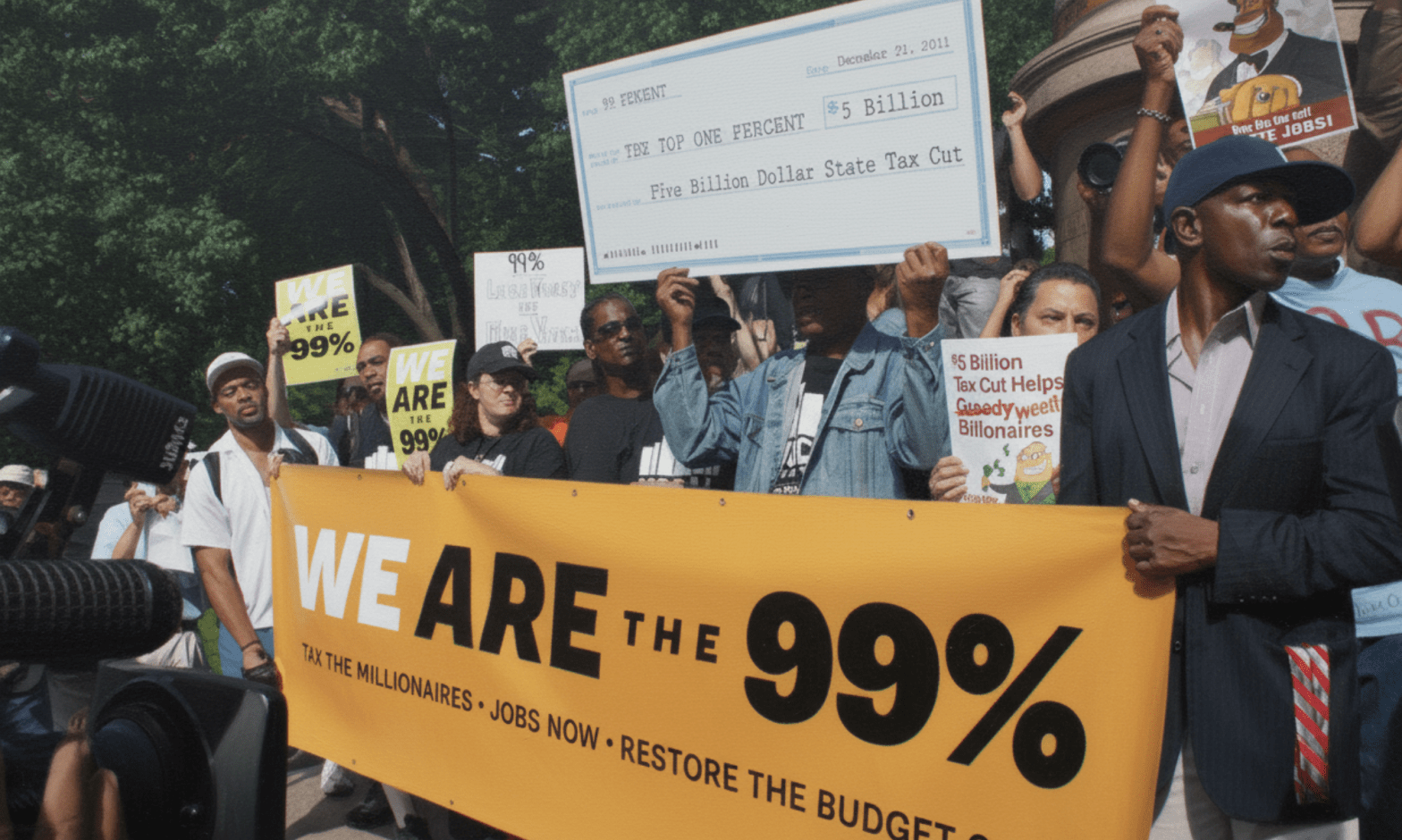

The Occupy Movement has been built around this premise.

Why is this view relevant to applied sociology? Theories of social change and revolution demonstrate how to transition the current world order into a new structure.

What does Wall Street look like if it was working as an equitable, transparent and well-regulated social institution? What social policies and social practices are required in order to shift its current practices?

Madrick writes:

We can’t do without Wall Street. Even the Occupy movement wouldn’t argue for its extinction. Someone has to keep our money safe. Making loans with savers’ money to businesses that need it is generally a good idea. Someone has to enable us to make check and credit card transactions, not to mention provide us cash. And someone should offer opportunities for small investors to buy stock and other investments at low costs… And, most important, there should be ways to channel Americans’ savings into investment in business.

But that’s not the Wall Street we have. It has used Americans’ savings to make wildly risky trades that fed bankers’ profits. It has not abided by free-market practices. It has traded complex securities in secret; it is rife with conflicts of interest; it has charged monopoly fees to underwrite securities, advise on takeovers, manage portfolios and make loans. Wall Street has paid its workers to take risks and hasn’t penalized them when they were wrong….

If we began to believe that Wall Street is expendable, perhaps we would regulate it properly so that it would do what it should do, and only that. It should provide a place for Americans to put their savings and channel those savings into the most productive investments, not a round-robin of one casino-like speculation after another.

What do you make of this? Do you work within an economic institution and if so how does your role as a sociologist fit in? How can applied sociology help in reforming free markets?

Quote and centre image: Washington Post. Top image: original via CNN, remixed by Sociology at Work.

Discover more from Sociology at Work

Subscribe to get the latest posts sent to your email.